Cryptocurrency has been influencing the financial world, and it's no different in India. With the rise of digital currencies, there's a growing interest in understanding how these assets are taxed. But with complex regulations and a rapidly evolving crypto landscape, staying up-to-date on the latest developments can be challenging.

As a crypto enthusiast or investor, it's crucial to understand the tax implications on your digital assets. Not only does this help you stay compliant with the law, but it ensures you're making the most of your investment by managing the tax burden. Whether you're a seasoned crypto trader or just starting, this article will help you navigate India's complex world of cryptocurrency taxes.

By the end of this article, you'll have a clear understanding of cryptocurrency taxes and be better equipped to manage your crypto investments. So, let's dive in!

Overview of Cryptocurrency Taxes in India:

The 2022 Budget introduced Section 115BBH to tax digital assets and cryptocurrencies. According to the section, a 30% tax rate (excluding the 4% cess and surcharge) is imposed on all cryptocurrency transactions. This rate is equivalent to the highest income tax bracket in India. It applies to commercial traders, private investors, and anyone who transfers crypto assets during the fiscal year.

It is important to note that the 30% tax rate applies regardless of the nature of the income, be it from business or investment income, and there is no differentiation between short-term and long-term gains, as is the case with stocks or bonds.

When it comes to calculating crypto taxes, there are several vital points to consider:

- No deductions for expenses are allowed.

- Acquisition costs can be excluded.

- Crypto losses cannot be subtracted from gains.

- Offsets or losses from other sources of income (business, salary, or house property) cannot be included.

- Carry-forwarding crypto losses to future years for offsetting against crypto income is prohibited.

The standard for crypto taxation in India:

In the Union Budget 2022, Indian Finance Minister Nirmala Sitharaman declared that cryptocurrencies would be classified as virtual digital assets for tax purposes.

Here's a breakdown of the tax implications for various crypto-related activities:

- Taxable Crypto Activities:

According to section 115BBH of the Finance Bill, the following activities involving virtual digital assets (VDAs) are subject to taxation:

- Converting VDAs into Indian Rupees or any other fiat currency

- Converting one VDA to another (such as crypto-to-crypto trading, including stablecoins)

- Paying for goods and services using a virtual digital asset

Profits from these transactions are taxed at a rate of 30%, with an additional 1% TDS imposed for transactions above 10,000 INR. However, if an individual or HUF is a specified person,i.e. if they do not have any income from Business or Profession OR if total receipts do not exceed INR 1 crore in case of a business or INR 50 lakh in case of professional income, then no TDS u/s 194S is payable for transactions upto INR 50,000.

- Other Crypto Activities Taxed at 30% :

Other crypto-related activities, such as:

- Gifting of cryptocurrencies

- Staking rewards

- Receiving of payments

- Mining

- Airdrops

- DeFi transactions

These transactions are viewed as income and taxed according to the recipient's income tax rate. However, if the recipient holds the assets and sells them later, they are liable to pay a 30% tax on any appreciation in the market value of the investment.

- TDS on Cryptocurrency Transactions:

In India, a 30% tax on VDA (Virtual Digital Assets) transactions is imposed, and a TDS (Tax Deducted at Source) of 1% is also levied. Introducing TDS on cryptocurrency is to monitor and record investments in crypto assets made by Indian investors.

It is important to note that TDS is imposed on trades, spends, or sales, not on transferring assets from one wallet to another. Here are some critical points regarding TDS on cryptocurrency assets:

- When trading through Indian exchanges, TDS will be deducted directly from transactions and submitted to the Government.

- When transacting through P2P platforms, the buyer is responsible for deducting TDS.

- In the case of crypto-to-crypto trades, both the buyer and seller are required to pay 1% TDS.

- Taxation on Crypto Losses:

115BBH prohibits investors from offsetting any losses against crypto gains. Indian crypto investors are not allowed to claim any cryptocurrency-related expenses except the cost of acquisition or buy price.

- Crypto Activities Exempt from Taxes in India:

Are you looking for ways to manage your tax liabilities from cryptocurrencies? There are specific scenarios where you are exempt from paying taxes on cryptocurrency, such as:

- Holding crypto assets (HODLing)

- Transferring crypto from one wallet to another

- Receiving a gift of cryptocurrency worth up to Rs. 50,000 from close family members. This amount can only be exempt from crypto taxes and cannot exceed this limit. (Subsequently, on selling the gift received, tax under Section 115BBH is payable)

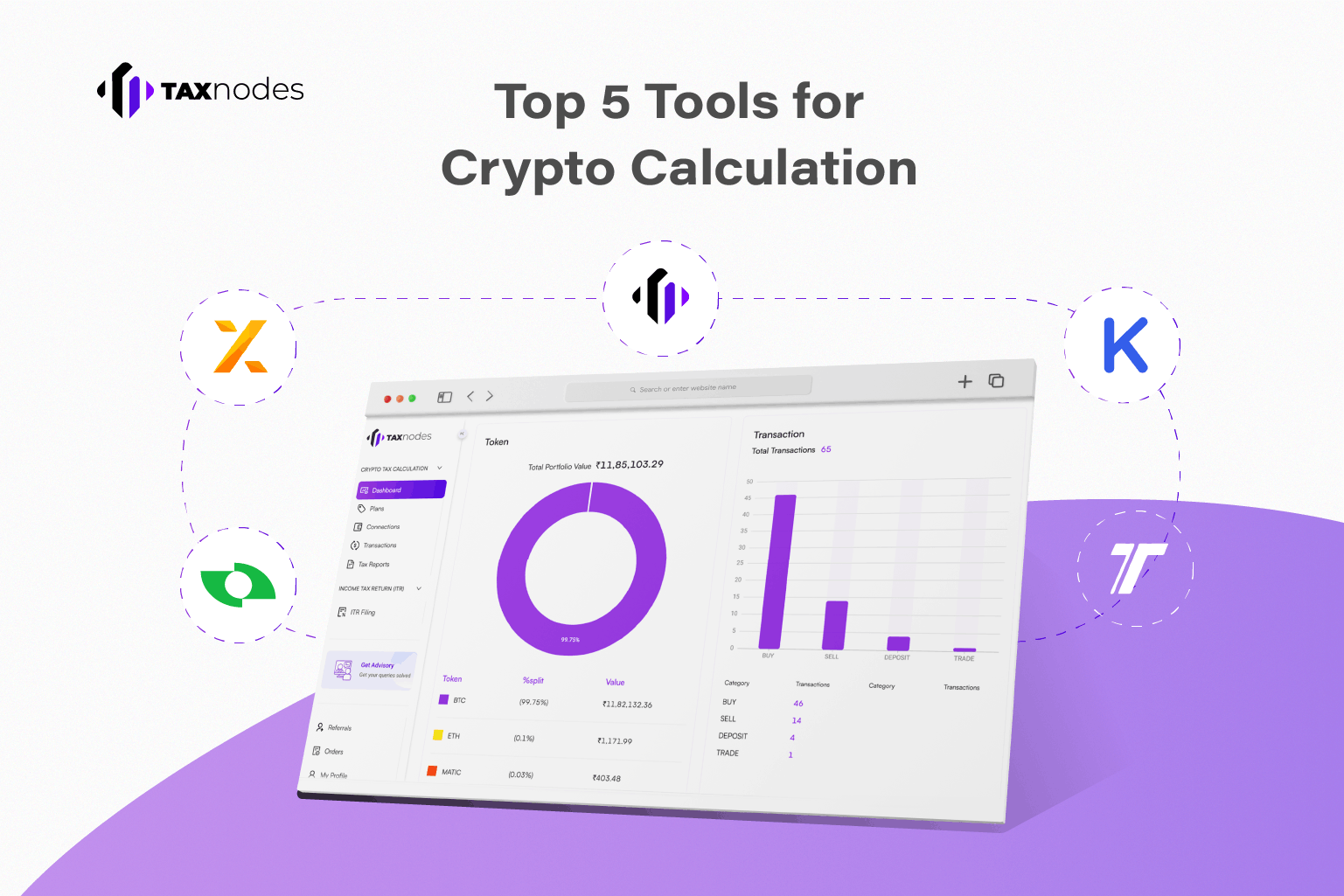

How to calculate crypto taxes in India:

The first step to calculating taxes on cryptocurrency transactions is to determine the capital gains. Capital gains are profits from selling or disposing of a capital asset, in this case, cryptocurrency. If an individual bought cryptocurrency worth INR 3,00,000 and sold it for INR 5,00,000, their capital gain would be INR 2,00,000. This amount is multiplied by 30% to calculate the taxable amount, which comes out to be INR 60,000 (excluding surcharge and cess). The individual will be liable to pay INR 60,000 plus a 4% cess and surcharge as the tax on their crypto income in that financial year.

It's important to note that any income derived from cryptocurrency transactions is taxed only at the time of transfer of assets. Therefore, holding onto cryptocurrency assets does not make unrealized gains taxable. In addition, the Government does not allow any expenses, other than the cost of acquisition (purchase price), to be deducted as expenses from the profit. This includes platform fees, brokerage fees, and internet charges.

Starting July 1, 2022, a 1% TDS (Tax Deductible at Source) was introduced on all crypto transactions under section 194S of the Income Tax Act. This means that for a crypto purchase worth INR 10,000, INR 100 will have to be paid as TDS, and the remaining INR 9,900 will be delivered to the seller. However, some crypto exchanges may automatically deduct the TDS and deposit it to the Government, subject to special conditions.

It's essential to remember that TDS will be imposed on all crypto transactions, including Crypto-to-Crypto Transactions. The Indian Government is taking steps to discourage short-term crypto transactions but has not prohibited cryptocurrency trade.

Conclusion

The tax measures taken by the Indian Government are comprehensive and clear about the extent and scope of taxes to be paid. Hence there are almost no routes to evade taxes on cryptocurrencies. Consequently, all the crypto exchanges are working towards establishing platforms for compliance with the Government's directives.

Therefore, we recommend you keep detailed records of all cryptocurrency transactions and try to find professional tax advice. Seeking the guidance of a tax professional can help you navigate the legal requirements and ensure that you abide by the laws.

byRhea Tripathy

Meet Rhea Tripathy, a word wizard with a pen in one hand and a paintbrush in the other. By day, she slays as a content writer and by night, she indulges in her artistic passion. With a keen eye for the markets and a knack for literature, this certified trader brings her sharp mind and creative flair to everything she does. When she's not crafting clever content, you'll find her analyzing the latest market trends or getting lost in a good book.