Is Virtual Digital Assets (VDAs/Crypto) profit taxable in India?

The short answer is yes; any gain/profit from the transfer of crypto is and was always taxable in India.

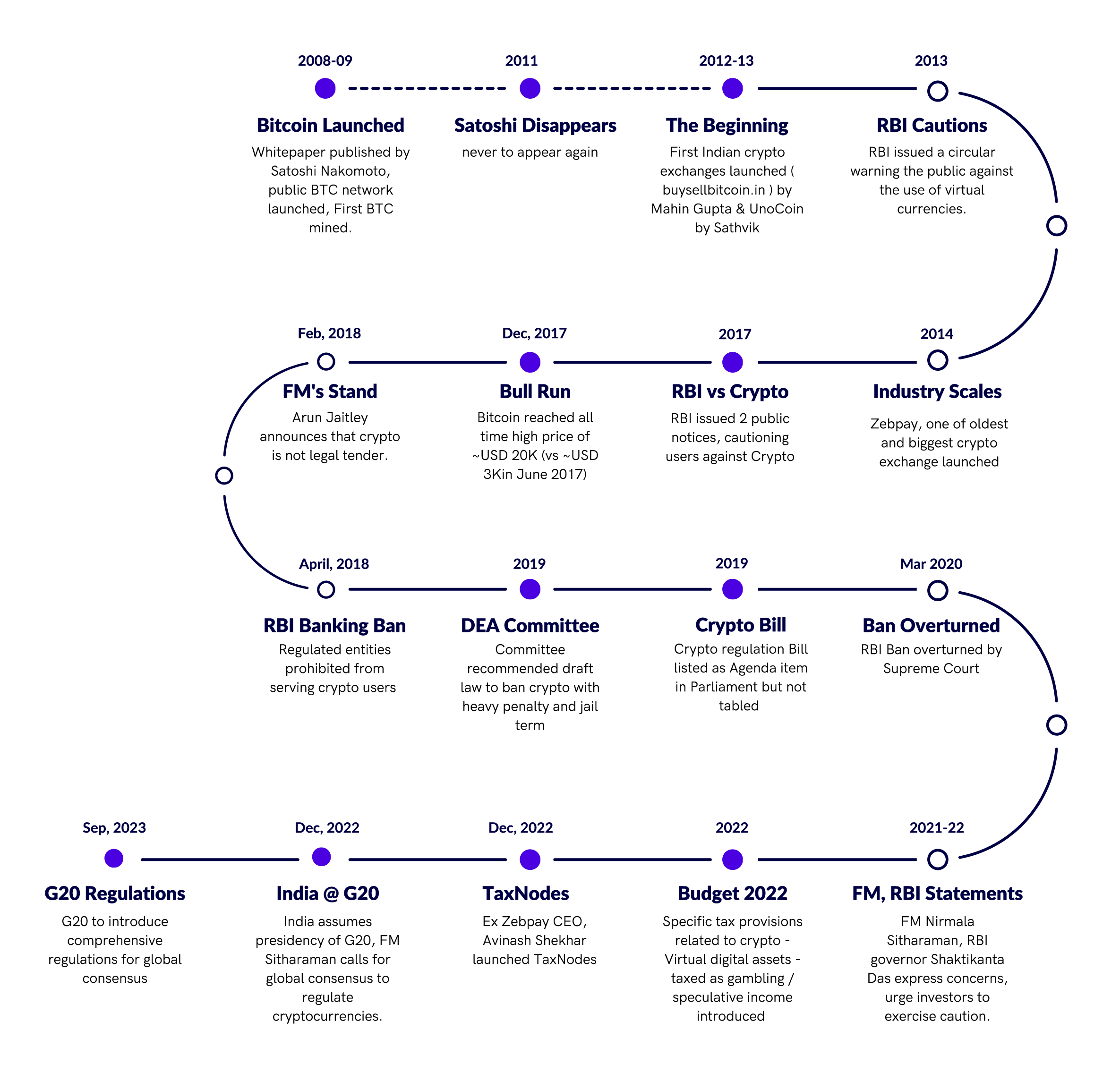

Last year the Government of India brought specific laws for taxing crypto profit. However, not many people are aware that crypto was taxable under the general income tax laws even before the enactment of specific laws.

What is VDA?

As per the Income Tax Act, the term 'virtual digital asset' encompasses any form of data, code, numeral, or token, excluding Indian currency or foreign currency, created through cryptographic methods or other means and can be referred to by any name.

These assets can be electronically transferred, stored, or traded. Additionally, the definition of virtual digital assets includes non-fungible tokens (NFTs) or any similar token, regardless of their name.

What are Non-fungible tokens (NFTs)?

To understand NFTs, let us first dive into the concept of fungible assets as compared to non-fungible.

Fungible assets are interchangeable and indistinguishable, meaning that each unit holds the same value and can be exchanged on a like-for-like basis, such as traditional currencies or commodities like gold. On the other hand, non-fungible assets are unique. They cannot be directly exchanged with other assets as they possess distinct characteristics or properties, often associated with individual ownership or proof of authenticity, like collectable items or digital artwork.

Non-fungible tokens (NFTs) are assets converted into tokens using blockchain technology. They are uniquely identified by specific codes and metadata, setting them apart from other tokens. NFTs can be bought, sold and exchanged for money, cryptocurrencies, or other NFTs. In addition, they can represent various digital or physical items, such as artwork, real estate, individual identities, property rights, etc.

Regulations after 1st April 2022

Implementing the Finance Act 2022, a new provision called Section 115BBH has been introduced, effective from April 1, 2022, for the financial years beginning April 1, 2022. This section outlines the taxation rules for income generated from the transfer of Virtual Digital Assets (VDA) at a flat rate of 30%. As a result, any income derived from transactions involving Virtual Digital Assets on or after April 1, 2022, will be subject to taxation under Section 115BBH, regardless of any other applicable laws.

Here are the key provisions of Section 115BBH:

Section 115BBH - Tax on income from virtual digital assets:

- If an individual's total income includes any income from the transfer of virtual digital assets, the income tax payable will be the total of:

a. Tax calculated at a rate of 30% on the income from the transfer of such virtual digital assets, and

b. No deduction for expenses (except the cost price, if applicable) or allowance or set off of losses will be permitted in the computation of income from VDAs.

Example - Mr Raj works with ABC company limited as an engineer and receives a salary of ₹20,00,000 annually. He additionally received gains from trading in VDAs of ₹3,00,000. Mr Raj will have to pay taxes on his salary income as per individual slab rates; however, the profits from VDAs will be taxable at 30%, amounting to ₹90,000. - Losses incurred from the transfer of virtual digital assets, as computed under, cannot be set off against income computed under any other provision of the Income Tax Act.

As the regulations are not descriptive enough, some tax experts are of the view that, as per the current language of the law, losses from one VDA can be set off against the profits of another VDA. However current income tax return form issued by the department does not allow such a set-off. Furthermore, such losses cannot be carried forward to subsequent assessment years.

Based on the provisions outlined in Section 115BBH, the following key points emerge:

- This section introduces a separate tax system for income derived from the transfer of virtual digital assets;

- Income from the transfer of virtual digital assets will be calculated separately for taxation purposes;

- The income from the transfer of virtual digital assets will be subject to a flat tax rate of 30%;

- The tax on the transfer of virtual digital assets will be applicable regardless of whether the income is below the threshold limit or if the taxpayer has incurred a loss; and

- Losses from the transfer of virtual digital assets cannot be set off against any other income, including income from the transfer of other virtual digital assets.

When an individual's total income includes income from the transfer of virtual digital assets, the income tax payable will be the total amount of income tax calculated at a rate of 30% on the income from the transfer of virtual digital assets.

Additionally, it will include the amount of income tax that would have been applicable if the individual's total income had been reduced by the income from the transfer of virtual digital assets.

Furthermore, none of the specified heads of income mentioned in Section 14 of the Act is applicable for the computation of income from the transfer of virtual digital assets. Typically, if the income is not taxable under the heads of "Profits and Gains from Business and Profession" or "Capital Gains", it is taxed as "Income from Other Sources".

Regulations before 1st April 2022

While the introduction of Section 115BBH in the Income Tax Act on April 1, 2022, marked the explicit inclusion of virtual digital assets (VDA) in the tax regime, the taxation of VDA before this development was not clearly defined.

Individuals engaged in holding, trading and exchanging virtual digital assets fell under the scope of the comprehensive definition of 'income' outlined in Section 2, Clause (24) of the Income Tax Act, 1961. This definition encompasses various types of income, which are subject to taxation. A popular belief existed before 1st April 2022 that crypto was declared illegal; contrary to popular belief, crypto was never declared illegal in India. As per general law, anything not declared illegal is construed as legal.

Various approaches adopted by taxpayers on VDA taxation in the absence of clear guidelines by the government:

- If VDA was treated as a business commodity, it was considered taxable under business income.

- If VDA was held as a capital asset, the income derived from it was categorised as 'Capital Gains'.

- In cases where VDA transactions were occasional, the income was reported under the head of 'Income from Other Sources'.

- Since there was no specific tax rate specifically applicable to VDA income, it was subject to either the rate for capital gains or the normal slab rates applicable to the taxpayer.

In summary, even before the separate provisions introduced on April 1, 2022, income from such assets was subject to taxation of virtual digital assets.

Tax Deducted at Source (TDS)

Tax Deducted at Source (TDS) is a mechanism employed by tax authorities to ensure the collection of taxes at the source of income generation. It requires the person making the payment to deduct a certain percentage of the payment as tax and remit it to the government on behalf of the recipient. This system helps prevent tax evasion and promotes efficient tax administration. TDS applies to various types of income, such as salaries, interest, dividends & professional fees and acts as an advance payment towards the recipient's overall tax liability.

TDS on crypto assets:

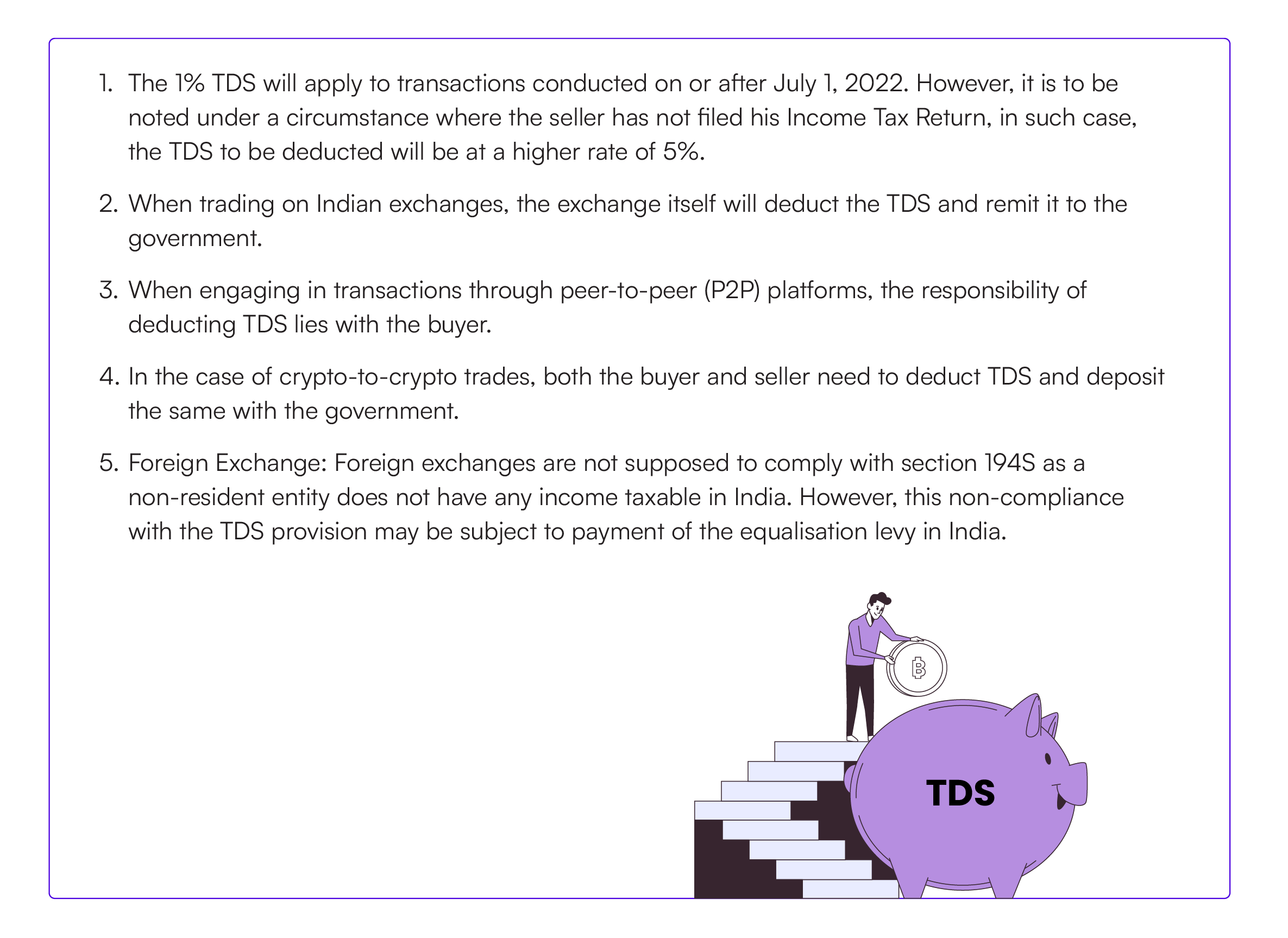

By the recent guidelines from the Income Tax Department (ITD), a 1% Tax Deducted at Source (TDS) will be imposed on the transfer of crypto assets. This measure aims to ensure the comprehensive recording of transaction details and monitor investments made by Indian investors in crypto assets.

It is essential to clarify that "transfer" refers to any change of ownership, such as a sale or trade, rather than simply transferring assets between your wallets. In simple words, the transfer will include buying and selling on Indian exchanges.

Q1: Mr A, an Indian resident, sold 1 BTC on an Indian exchange. The gross amount for the transaction was ₹1,00,000. What will be the TDS implications?

A: As per Section 194S, the TDS will be applicable at 1% so Mr A will receive ₹99,000 as a final payment.

Q2: Mr A, an Indian resident, purchased 1 BTC on an Indian exchange. The gross amount for the transaction was ₹1,00,000. What will be TDS implications?

Case 1 - If the seller of 1 BTC is an Indian resident, the seller will deduct TDS @1%, and the net amount received by Mr A will be ₹99,000.

Case 2 - If the seller of 1 BTC is not an Indian resident, it depends on the exchange; if the transaction is on an Indian exchange, such exchange will comply with TDS requirements. However, if the exchange is not an Indian exchange, no TDS compliances will be required.

It is to be noted that CBDT has issued a circular that mandates Indian exchanges to comply with all TDS requirements for the sale and purchase of VDAs on such exchanges.

Key points regarding TDS on crypto assets are as follows:

It should be noted that if the consideration for a transaction is payable by a "specified person" and the total value of their crypto trading activities remains below INR 50,000 within a single financial year, no TDS deduction is required. However, in other cases, such a limit is INR 10,000.

A specified person refers to an individual or HUF (Hindu Undivided Family) whose:

- Total sales/gross receipts/business income is up to INR 1 Crore, or

- Total sales/gross receipts/professional income up to INR 50 Lakhs, or

- An individual or HUF who is not having any income under business and profession.

These provisions seek to streamline taxation and reporting processes in the crypto industry, promoting transparency and regulatory compliance among market participants.

When engaging in trading activities on Indian exchanges, the responsibility for fulfilling Tax Deducted at Source (TDS) compliances rests with the exchange itself, thereby relieving individuals of any direct action. However, in the case of peer-to-peer (P2P) transactions and transactions conducted on international exchanges, individuals classified as specified persons must adhere to specific TDS payment and filing requirements.

Consequences of non-compliance with TDS provisions:

- Failure to deduct TDS: If a taxpayer fails to deduct TDS where he was supposed to do so, in such case, the Income Tax Department, as per Section 271C, levies a penalty that can go up to the actual TDS amount. Additionally, an interest of 1% per month will be applicable for the period of delay.

- Failure to deposit TDS: A taxpayer who fails to deposit the TDS within the specified time limit can face imprisonment for a period of 3 months to 7 years as per section 276B. Additionally, an interest of 1.5% will be applicable for the period of delay.

- The taxpayer can be treated as an assessee in default u/s 201 of the Act, due to which an additional penalty will be levied by the authorities.

Income Tax Return

The taxpayer is responsible for communicating the details of taxable income and losses to the Income Tax Department. These details are communicated to the Income Tax Department in the form of an Income Tax Return. The department has stringent rules regarding the non-filing and late filing of returns.

Consequences of not filing ITR:

- Interest: If you file your tax return after the due date, you will be charged interest under Section 234A at a rate of 1% per month or part month on the unpaid tax amount.

- Late fee: A fee of ₹5,000 under Section 234F must be paid, which is reduced to ₹1,000 if your total income is below ₹5,00,000.

Have you not disclosed your income from VDAs in return for A/Y 21-22 - you still have an option:

The Finance Act of 2022 brought relief for taxpayers who have missed filing their ITR in previous years. As per the newly added provision u/s139(8):

However, under a circumstance where the taxpayer does not resolve to the remedy mentioned above; the Income Tax Department may, on the basis of the nature of holdings, transactions in VDAs and intention of parties, include such earnings under Business Income or Income from Capital Gains.

The Income Tax Department, by virtue of powers vested u/s 147, conclude such additions by initiating re-assessment proceedings under which the department can reassess the incomes of the past ten years subject to certain conditions.

Audit

- If a business's sales, turnover, or gross receipts exceed Rs. 10 crores in a financial year and if cash transactions account for less than 5% of the total transactions, the taxpayer is obligated to undergo a tax audit.

- Turnover for audit: For Tax Audit purposes, the turnover shall be computed in a similar manner as for any other Business Profits, except that the deductions available for other businesses shall not be allowed.

- Therefore, an investor who is trading in VDAs in voluminous transactions and has crossed the threshold limit of 10 crores will be liable for a compulsory tax audit for the relevant previous year.

- Additionally, an investor who is involved in derivatives trading in VDAs will also be subject to a tax audit if the threshold limit is crossed.

Special Cases

Airdrops

An airdrop is a method of distributing cryptocurrency tokens or coins directly to designated wallet addresses, typically without a charge. Airdrops are employed to raise awareness about a particular token and enhance liquidity during the initial phases of a new digital currency.

Any cryptocurrency received as an airdrop will be subject to tax as per individual income rate based on the fair market value (FMV) of the token at the time of receipt. To determine the amount of income you have received, you can calculate the fair market value of the tokens in Indian Rupees (INR) on the day they were received.

The receipt of Airdrops without consideration shall be considered as income from other sources. The value of such Airdrop shall be fair market value on the date of receipt. Additionally, any expenditure incurred by the customer towards receiving Airdrop shall be allowed as a deduction.

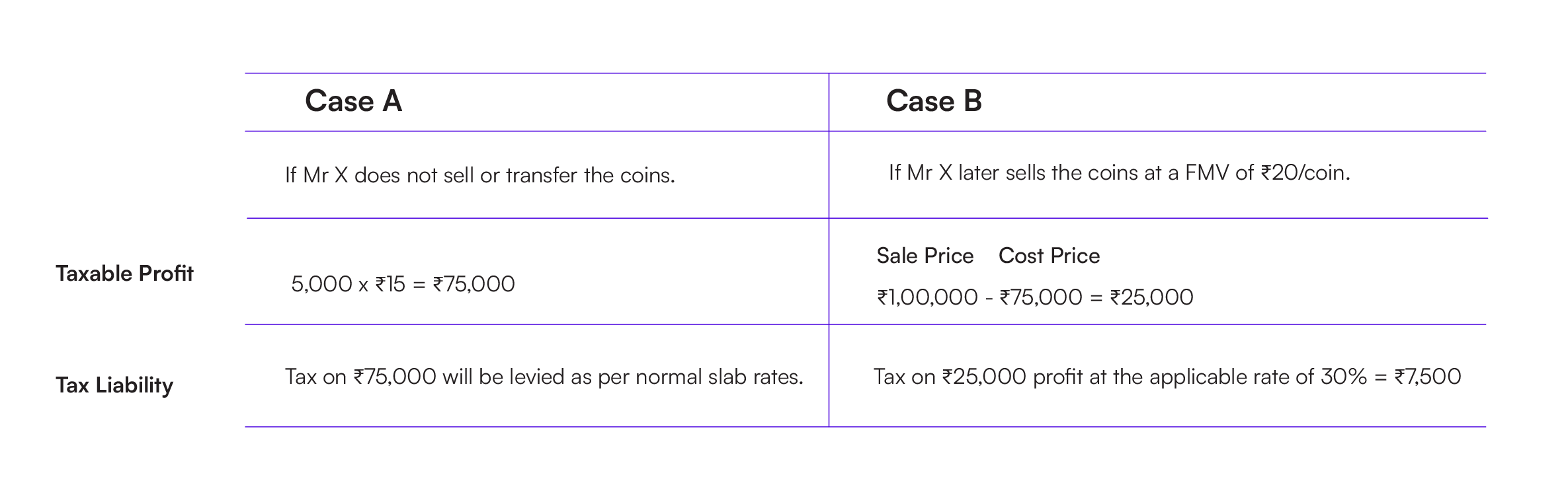

Upon the sale of the cryptocurrency at a subsequent stage, the income arising shall be taxable at the rate of 30%. In computing the income arising therefrom, the formula shall be the sale price received less the cost price of VDAs. The cost price shall be the fair market value of the Airdrops determined at the time of its receipt.

Let’s understand the tax implications of receiving airdrops with some examples:

Scenario 1: Mr X received an Airdrop of 5,000 DOGE coins on 1/04/2022. The fair market value (FMV) of each DOGE coin was ₹15.

Mining

Mining involves the verification and recording of transactions on a blockchain network using high-performance computers or specialised mining hardware. Within the blockchain network, a group of nodes or computers known as miners compete to solve intricate mathematical problems to validate transactions. The miner who successfully solves the puzzle first is granted a specific amount of cryptocurrency as a reward, the exact value of which depends on the particular blockchain network.

Income generated from mining can be classified as follows:

- If mining serves as the primary business activity of the entity, the income will be subject to taxation under the category of 'Business Income'. In such cases, individuals operating a mining farm are eligible to deduct expenses related to running the farm.

- The rewards of mining will be considered as business assets of the miner. Furthermore, if the miner holds such rewards as investments, then such will be considered as capital assets.

- Upon the sale of these cryptocurrencies at a subsequent stage, the income arising therefrom to the miner at the rate of 30%. In computing the income arising therefrom, the formula shall be sale price received less cost price. The cost price shall be the fair market value of the cryptocurrency determined at the time of its receipt.

It is advisable to seek guidance from a knowledgeable accountant to understand the potential tax consequences associated with crypto-mining activities.

Staking

Staking refers to the process where users validate transactions on the blockchain and receive rewards. One of the critical benefits of staking is the ability to earn passive income without needing to sell the underlying cryptocurrency.

There are four primary methods of staking:

- Running a validator node: This involves becoming a validator by running the necessary software and hardware. In the case of Ethereum, you need to possess 32ETH to participate in solo staking as a validator.

- Delegating using a non-custodial wallet: Instead of running your own validator node, you can delegate your ETH to a validator node using a non-custodial Ethereum wallet.

- DeFi staking protocols: There are decentralised staking protocols like Lido or Rocket Pool that provide options for staking your assets.

- Centralised staking products: Some centralised exchanges, such as Binance or Coinbase, offer staking services where you can stake your assets.

To better understand these methods, let's use Ethereum as an example. If you have 32ETH and the necessary software and hardware, you can stake directly as a validator. Alternatively, you can delegate your ETH to a validator node using a non-custodial Ethereum wallet. Additionally, decentralised staking protocols like Lido or Rocket Pool are available for staking. Finally, centralised exchanges like Binance or Coinbase also offer staking options.

However, it is essential to note that the Income Tax Department has not provided specific guidelines regarding the taxation of staking rewards. Nevertheless, suppose you participate in staking as a part of a Proof of Stakes (PoS) consensus mechanism. In that case, paying Income Tax at your individual rate is likely required upon receiving staking rewards.

The income generated from staking is considered normal and subject to taxation at the regular slab rates. Therefore, when you engage in staking, it is important to be aware of potential tax obligations on your earnings.

The taxable amount will be based on the FMV of the received tokens in Indian Rupees (INR) on the day of receipt or accrual, as the case may be. Furthermore, when you decide to sell, swap or spend your staking rewards at a later stage, you will be responsible for paying a 30% tax on any profits made.

Consultancy Fee

Under the circumstance where an Indian resident receives VDAs as consultancy fees, the same shall be included in total income as Business Income. At present, there are no guidelines on the valuation of such VDAs; therefore, one may value such VDAs at their fair market value on the date of receipt. Additionally, any expenditure incurred for providing such consultancy services shall be allowed as a deduction.

Salary

Under the circumstance where an Indian resident receives VDAs as salary, the same shall be included in total income as Income from Salaries. At present, there are no guidelines on the valuation of such VDAs; therefore, one may value such VDAs at their fair market value on the date of receipt. Additionally, the employee shall not be allowed to claim any expenditure except the ones mentioned in u/s 16 of the Act.

If the consultant or employee holds such VDAs for investment purposes, then the same shall qualify as Capital assets. Upon the sale of these cryptocurrencies at a subsequent stage, the income arising therefrom shall be taxable u/s 115BBH of the Act at the rate of 30%. In computing the income arising therefrom, the formula shall be sale consideration received less cost price. The cost price shall be the fair market value of the cryptocurrency determined at the time of its receipt.

Loan

Where an Indian resident advances loans in terms of VDAs, the same shall be considered as debt in the hands of the borrower accordingly; interest received against such loan shall be included in the total income as Income from Other Sources and shall be taxable accordingly. The value of such VDAs received as interest shall be valued at the fair market value on the date of receipt. Any expenditure incurred in terms of such loan shall be allowed as a deduction u/s 57 of the Act.

Trading in VDAs' Derivatives

- A derivative is a financial contract with a value derived from an underlying asset. Derivatives have no direct value of themselves; their value is based on the expected price movements of their underlying asset. When the underlying asset is a cryptocurrency like Ethereum, they are termed cryptocurrency derivatives.

- It is pertinent to note that, with a combined reading of section 2(47A) and 115BBH, it can be construed that derivatives will not qualify as VDAs, and the investor will not be required to pay tax u/s 115BBH as there is no actual transfer of VDAs. Hence cryptocurrency derivatives are in the nature of speculative transactions, which are ultimately settled by means other than actual delivery; thus, such derivatives shall be taxable under Business Income.

- Additionally, TDS provisions are not attracted in the case of derivatives.

Decentralised Exchanges

Active traders who engage in the trading and transferring of Virtual Digital Assets (VDAs) on decentralised exchanges need to understand that there is no difference in taxation whether you trade on a centralised or decentralised exchange. Therefore, computation of gains, cost price and period of holding will all be calculated in the identical manner as done for centralised exchanges. Furthermore, the provisions outlined in section 115BBH apply to Indian residents involved in trading activities on decentralised exchanges.

Foreign Exchanges

A popular opinion amongst investors is that income generated through VDAs on foreign exchanges is not taxable; contrary to this, the law states that the total income of an Indian resident is taxable. Therefore, it is irrelevant whether income is on Indian exchanges or foreign exchanges.

Therefore, it is pertinent to note that any income generated through foreign exchanges, whether through trading or any other means, will be subject to taxation at a rate of 30%. However, the TDS provisions will not be applicable to such foreign exchanges.

Set off and carry forward losses

A plain reading of Section 115BBH (2) added by Union Budget, 2022 provides us with the following two situations:

- Income from the transfer of VDAs cannot be set off against loss from any other head of source.

- Loss from the transfer of VDAs cannot be set off against income from any other source.

- It must be noted that the set-off of loss is not a choice given to the assessee. Instead, it is a statutory provision that is required to be followed while computing total income.

- The losses from VDAs cannot be carried forward to the subsequent financial years.

However, on interpreting the law, it can be construed that the provision of set-off shall apply only when there exists a different source or head of income. When income is to be computed only in respect of one source, the question of set-off of loss will not arise.

Hence profits from the transfer of some VDAs shall be automatically adjusted against loss from the transfer of other VDAs. Such an adjustment will not be called “set-off” and will be treated as “deductions” because the income is computed only under one source, i.e., trading in VDAs.

However, it is to be noted that there are certain practical differences in implementing the above analysis in the Schedule VDA added to Income Tax Return. The schedule provides details on a transaction basis along with details of profits earned per transaction. As the regulations are not descriptive enough, some tax experts have different opinions on the set-off of losses.

To get assistance computing your taxes on crypto income, use tax calculators like TaxNodes. By leveraging platforms such as TaxNodes, people can simplify their tax responsibilities, minimising the chances of non-compliance and the resulting penalties.

Determination of cost price and sale price

The legal provision under Section 115BBH mandates that the gross profit derived shall be subject to a tax rate of 30%. It is crucial to note that gross profit is determined by deducting the cost price from the sale price. Additionally, no deductions for expenses are permissible from the gross profit calculation.

Investors should be aware that VDAs are intangible assets held in dematerialised form. Consequently, the appropriate valuation method to be employed is FIFO (First In, First Out), akin to the valuation method used for shares and other dematerialised securities. Additionally, details of cost price and sale price will be considered on a per-transaction basis.

Conclusion

In conclusion, navigating the world of crypto taxation can be complex and challenging. The calculations involved can be intricate and time-consuming and the consequences of non-compliance can be severe, ranging from financial penalties and interest to potential legal repercussions, including jail time. Moreover, the government has the authority to reassess your income tax returns, adding further pressure to ensure accurate reporting.

Given the gravity of the situation, it is crucial for crypto users to comply with tax regulations fully. Fortunately, there are a few platforms available, such as TaxNodes, that can simplify the process and help users meet their obligations with ease. TaxNodes, an ITR filing platform, streamlines the process of tax filming, generating profit and loss reports with an impressive accuracy rate.

By utilising platforms like TaxNodes, individuals can streamline their tax obligations, reducing the risk of non-compliance and the associated penalties. Stay informed, stay compliant and take advantage of the available resources to streamline the crypto tax process and minimise potential risks.